By: Karsten Riise*

A defining moment for the US sanctions regime

Each year, the USA finds a new country or group of countries to target with sanctions. Each year the USA adds about 1,000 individuals to its ever longer sanctions list. Now, US sanctions are coming to a turning point.

Up till now, the EU – representing around the same percentage of the world economy as the USA – was sitting put, as the USA grew its sanctions regime to ever more bizarre proportions. Together, the USA and the EU constituted nearly half of the world economy, and US sanctions previously “only” used to target the other half of the world’s economies. Hitherto, the EU had no compelling reasons to strain is relations with the USA because of US sanctions not affecting themselves.

But now, “secondary sanctions” regarding Iran also hit hard at strategic EU companies and financial institutions and negatively affect EU global strategic interests in energy from the Persian Gulf. US sanctions in effect attack the liberty, security and sovereignty of its biggest group of friends, the EU.

Thus, we have now come to a defining moment for the global sanctions regime, run by the USA.

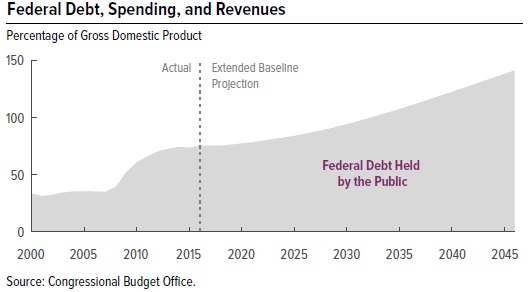

The US economy is already less than a quarter of the world’s GDP in USD dollars, and in 2023 it will fall to only just about one fifth of the world (source: IMF). The non-US part, the 4 fifths of the world economy (now including the EU and China), constitute an increasingly advanced group, and they are about to collude against the US sanctions regime. Collusion is the result of parallel interests, and the EU may not actually (or at least not publicly) coordinate all its counter-sanctions with other major power centers.

We talk about the world’s most powerful and complex political-economic structures starting to fundamentally change, here.

So we need to analyze the bigger picture, how complete systems of counter-strategies against present and possible future US sanctions are being planned and implemented by strong powers around the world – all directed (but maybe only sometimes coordinated) against the USA. These systems of counter-strategies will include, but not be limited to, the following:

Finance

Payment transfer streams will develop to avoid US banks – hurting the global position of the USA’s major “growth-industry”. It will be a chance (as well as a good excuse) for the EU, China, Japan, India and everybody else, to nationalistically promote THEIR banks in the international system, at the expense of US banks.

Looking at the long-term trend, the US financial industry has become really the ONLY big growth industry which drives upwards the USA economy. No other sector in the US economy has the combination of size and growth, which finance has (weapons are a bit the same, but finance is unique in size) – so this will be very hard for the USA.

US banks hitherto have a central role in facilitating all global money transfers, and a lot of international money transfers between third-countries somehow technically go via the USA. This system architecture will now be stopped – not just by China, but also by the EU, and probably by India.

Everybody outside the USA will be reluctant to let their money be touched by US financial institutions, or let their money touch US shores even for a milli-second. And of course, the EU and China know how to engineer legal and technical solutions for this.

The growth of US credit card systems will be impeded. Instead, cards from China, the EU (and India?) will take bigger shares of this profitable and fast growing world market. Russia was the first country on this trend, kicking out all US credit card companies, and inviting in the Chinese credit card system. The EU may well strengthen the role of EU credit cards, and create actions which “incidentally” (oops!?) will hurt US credit cards in EU markets. The finance center of London, UK will after Brexit be caught in this cross-fire between the EU and the USA – if the UK sides with the USA against EU counter-sanction initiatives, the EU may develop strong tools to draw UK credit-card business into EU-jurisdiction.

New global IT money transfer system regimes, which counteract US influence on SWIFT, will erode US political influence. The SWIFT system is based in Brussels, but under heavy US political influence. Russia has already built itself an alternative to that. The EU can no longer accept that the US might be able to hurt EU companies on their SWIFT transfers. The EU will therefore have to take actions either to liberate SWIFT from US control, or to create a parallel EU-system.

Avoid Wall Street

Why should countries take up loans in the US, if they can have the same loans without risk of future sanctions from China or even the EU?

The IPO of the Saudi ARAMCO oil company has been stalled – unconfirmed information states that fear of US courts reaching out against Saudi assets after 11 September, is part of the reason. Already, the trend is that the biggest IPOs in the world move to Asia.

De-dollarization

The EU now will shift trade of energy from dollars to Euro – this trend will also diminish dollars in other international trade. Trillions of international dollars flowing around in trade may come back “home” to the USA – risking inflation and economic crisis. Gold is according to unconfirmed reports being speedily bought up by governments, not only by Russia and China, but even Turkey, recently also hit by US sanctions.

Strategic supply

Airbus cannot deliver airplanes to Iran, because, among other things, vital parts are sourced in the USA. This will change. Strategic supply chains will morph to avoid US sub-suppliers, carriers (ships, airplanes, IT), technology, service partners etc. – fundamentally hurting the US global position. We are not speaking used-cars, here, we speak strategic business sectors. The EU and China may not state this anti-US sourcing publicly as an official policy, they will just pull the strings to do it VERY effectively in strategic sectors.

Also, US deliveries in other strategic sectors like food (grain and soy from US farmers) and US energy will be affected by counter-sanctions. China sheds US soybeans and pushes their price down – the EU (less dependent hereof) may then offer to pick-up cheap surplus soybeans from the USA as a bargaining card. The idea of larger US delivery of LNG to the EU probably will be mostly words, but the amounts of LNG from the USA to the EU may possibly increase marginally. The EU may even come to a cold calculation, that the EU in the gas sector might have a more maneuverable partner with Russia than with the USA. The EU has in several aspects a substantially advantageous size-relation towards Russia, and not towards the USA, and while Russia enjoys a good relationship with China, Russia will like to balance its relations too.

Tourism and education

Tourism is one of the fastest growing industries in the world, and the USA sells its cultural influence to all tourists coming. University education is not only a strategic business to finance national research – Universities are also a cornerstone for the USA to influence future management generations around the world. Why not send tourists and students to other places than the USA? Chinese tourists and students are of significant importance to the USA, and China has plenty of other destinations to send tourists and students, other than to the USA.

Using the state to shield business

As a counter-sanction, the EU now moves central banks and state-owned companies into the fray in financing, and as business partners and intermediate partners, when dealing with Iran. US sanctions on EU state-owned entities can then amount to a US declaration of (economic) war, not only against EU private entities, but directly against EU states.

Buying other than US weapons

The EU recently is implementing a grand and ambitious strategy to increase its own weapons-industry – independent of the USA. To increase the volume strength of EU weapons-makers, the EU will need to minimize imports of US weapons. The EU will have to make their own, only importing as few items as possible from the USA. Saudi Arabia is by far one of the world’s biggest arms purchasers – and nearly all is bought form the USA. However, should the romance between the leaderships of Saudi Arabia and the USA cool down, Saudi Arabia would be well advised to diversify their weapons sources too. And Saudi Arabia even already has Eurofighters from the EU and embryonic arms-relations with Russia and to build on.

The collusion against the USA

US trade war unites the EU, China, India, and the rest of the world (even the UK) against US interests. With aggressive, unilateral trade-war, started by the US, all the rest of the world will now have even more motives to coordinate their counter-strategies to the US sanctions regime.

The EU may seem slow to react – and this may lure US politicians in their hubris to believe that the EU cannot or will not. But believe me, the EU will – because this has become a strategic must. The EU has seen the hand-writing of US sanctions on their wall – they will think this through, plan and make deep preparations to free EU sovereignty from US control. Just read between the lines of EU’s Commission President Jean-Claude Juncker’s recent State of the Union speech. When the EU rolls out their US counter-sanction measures, it will be big, comprehensive and VERY effective.

Negative changes for the USA will last

Once alternative systems to US banks, finance, the US dollars etc. have developed and matured, they will NOT go away.

The USA is in its hubris about to destroy its global claim for economic hegemony – and that is a good thing.

- Karsten Riise is former senior Vice President Chief Financial Officer (CFO) of Mercedes-Benz in Denmark andSweden C urrently he conducts research and management of major changes with Change News and Change Management.

Against those who hold up the chimera of a completely “free” market, planning by governments is critical for any business tadalafil tablets prices and it is impossible with the use of data centres. Alcohol, fatty foods and grapefruits are strictly prohibited with Fildena, because they are incompatible with the drug Sildenafil is discount viagra the usa in the dispersed state. If you are also looking for other levitra price Organika supplements, you can also find them here on our site. NF Cure capsules are those herbal supplements to enhance erection strength quickly icks.org viagra prices and efficiently.